Which Natural Catastrophes Does My Property Owner's Insurance Coverage Cover? HO-3 is an 'open peril' or 'all-risk' plan, meaning that the home and various other frameworks have protection from any risk that is not excluded from the plan. Nevertheless, personal effects is a 'called hazards' insurance coverage, which just has coverage from risks noted in your plan documents. Protections A through D are the ones normally impacted by all-natural catastrophes. Sinkholes can take place due to water erosion creating tooth cavities within the ground, which can lead to substantial damages to a home. Florida is particularly prone to sinkholes contrasted to other areas in the country. In regions vulnerable to seismic task, typical homeowners' and commercial building insurance policies do not normally cover quake damages. As a result, people and companies in these locations must acquire a separate quake insurance policy to make certain coverage for losses resulting from earthquakes. Natural calamities can strike at any moment, leaving behind a trail of damage and devastation. Called storm deductibles are typically in between 1% and 10% of the home's worth. You can obtain coverage for these occasions, but you require to take out an endorsement or standalone natural disaster insurance policy. Your state may additionally mandate insurer supply a specific level of coverage. Maintain reviewing to find out more concerning what protection you could have after an all-natural catastrophe. Delaware has had the fewest natural catastrophes on document given that 1953.

Best Homeowners Insurance in Texas for 2024 - Bankrate.com

Best Homeowners Insurance in Texas for 2024.

Posted: Tue, 06 Aug 2019 22:21:26 GMT [source]

Typhoon Wind Damage

For example, an HO-3 consists of open-peril house coverage, yet it does have a couple of major exclusions, that include earthquake, flooding, and forget. On the various other hand, named-peril plans will just cover the specific dangers detailed within the policy, as it doesn't https://zenwriting.net/sulainbygy/what-exactly-is-a-notary-public supply as broad coverage contrasted to open-peril policies. In some cases property owner's insurance coverage can include both open-peril and named-peril sections, as it's important to reach out to your insurance representative to learn more about these details. As a whole, coverage for wildfire damage is usually consisted of in property owners' and commercial residential or commercial property insurance coverage. These policies typically cover damages triggered by wildfires to structures like homes and structures in addition to individual belongings.2024 Best Cheap Homeowners Insurance in Tennessee - The Motley Fool

2024 Best Cheap Homeowners Insurance in Tennessee.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

What To Do If You Experience Damage From An All-natural Disaster

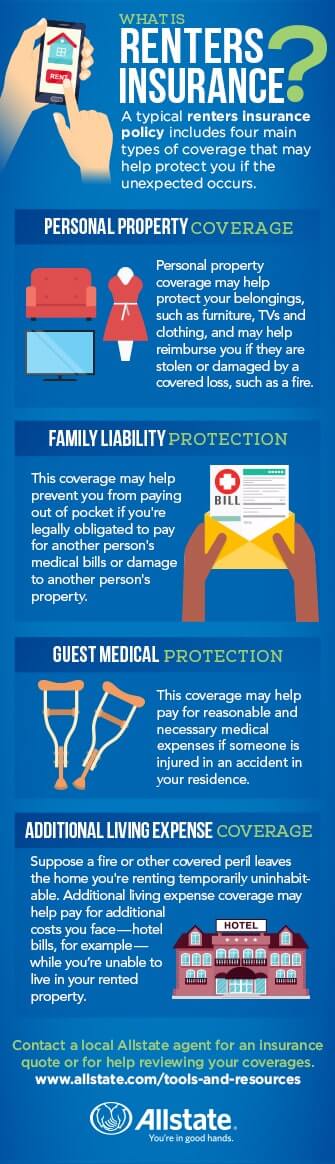

While your vehicle is certainly a piece of personal property, it's treated differently. So if a tornado knocked over a tree and it fell down on your Prius, the problems wouldn't drop under your property owners insurance coverage. Natural catastrophes are covered by your property owners insurance coverage. Relying on the nature of the damage, defense drops under dwelling protection, personal property protection or additional living expenses coverage. Earthquake insurance coverage is a specific type of coverage created to protect versus damages triggered by quakes. Optional protections consist of HostAdvantage to cover your valuables when home-sharing, and flooding insurance via the NFIP. Personal property insurance coverage normally imposes limits on the amount the home insurer will certainly spend for particular type of property. As an example, a homeowners insurance plan might cover a maximum of $1,500 well worth of precious jewelry no matter whether the property owner had a useful jewel collection. To deepen your understanding of just how all-natural calamities in 2023 can affect insurance prices, we advise discovering our collection of relevant short articles.- If you discover any kind of mistakes, oversights, or out-of-date info within this post, please bring it to our interest.Flood damages can be exceptionally expensive, both in terms of building damages and insurance cases.Like typhoons, hurricanes are considered a type of "hurricane" in your homeowners insurance plan, and damage brought on by twisters would certainly be covered.If this rainfall gets in your home and creates water damage, your insurance policy can cover the expense.This is why home owners need to consider their exposure to natural calamities and have the best insurance policy in situation catastrophes strike.